AU FA012 Form - Fill, Sign Online, Download & Print - No Signup

FA012.2407

1 of 12

Details of your

child’s care arrangements

(FA012)

When to use this form

Important information

Use this form to confirm your child’s care arrangements, or if you are applying for or receiving

Family Tax Benefit or Child Care Subsidy and your child(ren) spends time with someone other

than you and/or your current partner. For example, weekends, school holidays.

The information you provide is needed to calculate your rate of payment under family assistance

law.

This is not a claim for Family Tax Benefit and Child Care Subsidy. If you are not currently receiving

Family Tax Benefit or Child Care Subsidy for any children, and wish to claim, log into your

Centrelink online account through myGov, then select

Make a Claim

. You can claim for a range of

family assistance including Family Tax Benefit and Child Care Subsidy online. If you are already

receiving Family Tax Benefit for any children, you are not required to claim online as we will

automatically reassess your existing entitlement using the information provided in this form.

If there is a permanent change to your care arrangements after you have lodged this form,

call us on

136 150

as soon as you are aware of the change. If there are minor variations to your

care arrangements, for example a sick child does not stay with a contact parent for a weekend,

you do not need to tell us.

You can upload this form, with any supporting documents, online.

For more information about how to access an online account or how to lodge documents online,

go to

www.

servicesaustralia.gov.au/centrelinkuploaddocs

Returning this form

Check that all required questions are answered and that the form is signed and dated.

If you have been asked to provide the information in this form, you should complete and return

this form

within 14 days

.

Return this form and any supporting documents:

•

online

using your Centrelink online account through myGov. For more information, go to

www.

servicesaustralia.gov.au/centrelinkuploaddocs

• by post to

Services Australia, Families, PO Box 7802, CANBERRA BC ACT 2610

• in person at one of our service centres.

For more information

Go to

www.

servicesaustralia.gov.au/families

or visit one of our service centres.

Call us on

136 150

.

Information in your language

We can translate documents you need for your claim or payments for free.

To speak to us in your language, call

131 202

.

Call charges may apply.

Hearing and speech assistance

If you have a hearing or speech impairment, you can use:

• the National Relay Service

1800 555 660

, or

• our TTY service on

1800 810 586

. You need a TTY phone to use this service.

For more information about help with communication, go to

www.

servicesaustralia.gov.au

and search

‘other support and advice’.

Online account

Instructions

FA012.2407

2 of 12

Having a partner

We consider you to have a partner and be a member of a couple if you are either:

• married

• in a registered relationship. This is when your relationship is registered under a law of a state

or territory.

• in a de facto relationship. This is when you and your partner are in a marriage like relationship

but you are not married or in a registered relationship.

We may still consider you a member of a couple if you are not actually living with your partner.

For example, your partner may fly-in fly-out or live away for work, like military or oil rig workers.

For more information, go to

www.

servicesaustralia.gov.au/moc

Information about

shared care

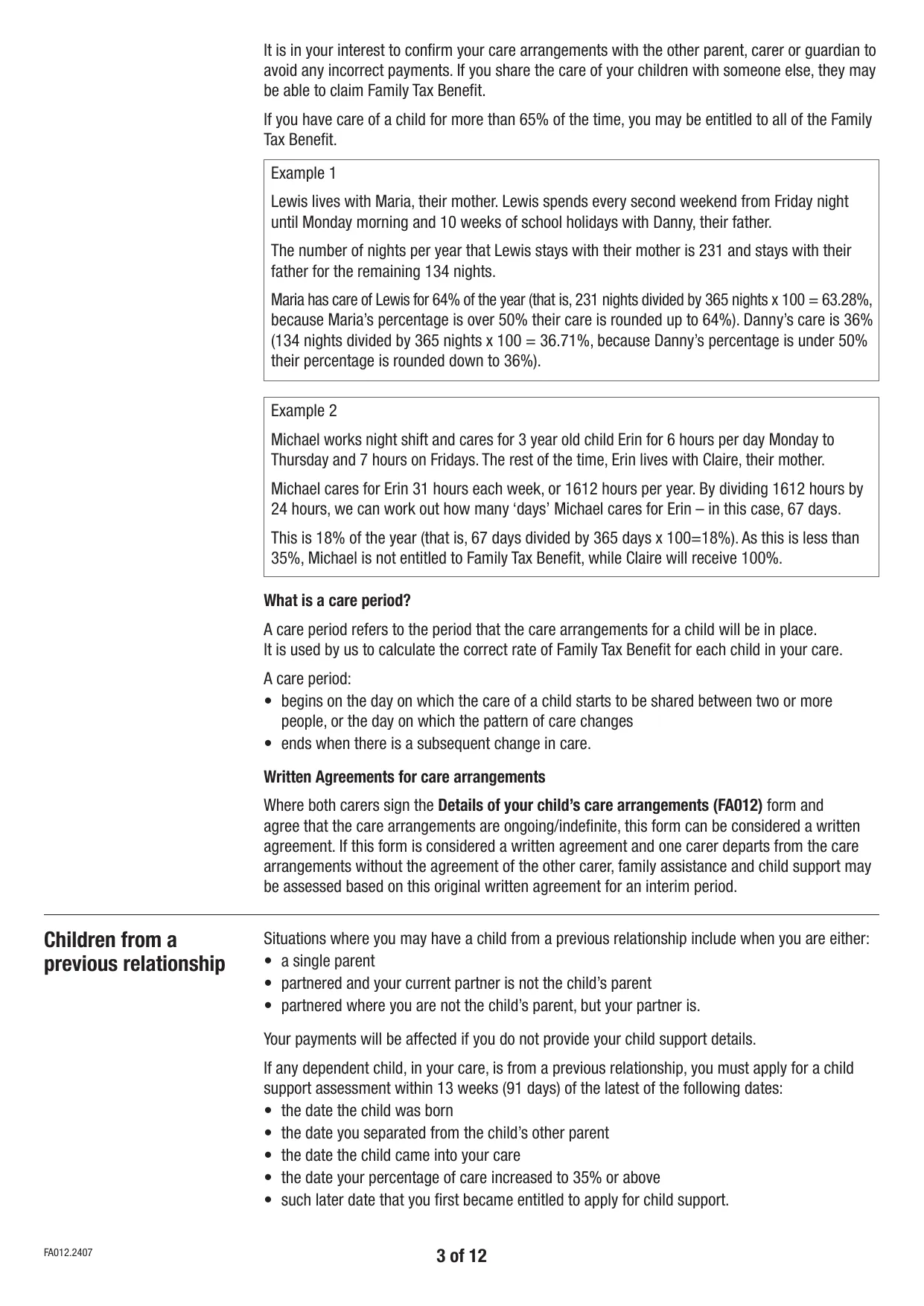

For both family assistance and child support purposes the same rules are used to work out your

level of care. This means one determination for shared care is used. If you share the care of a

child for at least 35% of the time, you may be entitled to Family Tax Benefit. The percentage of

Family Tax Benefit you can receive is based on the actual percentage of care you have of a child.

These are 2 different percentage calculations. The percentage of time the child is in your care

may not be the same as the percentage of Family Tax Benefit you are paid.

Sharing the care with a current partner or child care provider is

not

shared care.

How is shared care assessed?

• If you and the child’s other parent, carer or guardian have an agreed percentage of care, or an

agreed care arrangement, the care percentage applied to your Family Tax Benefit is based on

your care agreement.

• If you

do not

have an agreed percentage of care, or an agreed care arrangement, we will

decide the care percentage to be applied to your Family Tax Benefit based on the evidence of

your care arrangements.

If you think the number of nights the child is in your care does not accurately reflect the amount

of time you have care, you can tell us the total number of days and hours you have care. This

gives the total time you have care in the care period.

You can use the care calendar to let us know how often you care for a child. We will use this to

work out your percentage of care to calculate Family Tax Benefit payments and child support if

you are unsure or unable to calculate it. For more information, go to

www.

servicesaustralia.gov.au/carecalendar

Note: For the purposes of Family Tax Benefit, a person with the overnight care of a child is

generally regarded as having had care of the child for that day.

Percentage of actual care

for the child

Percentage of Family Tax Benefit

you may receive

0% to less than 14%

0%

14% to less than 35%*

0%*

35% to less than 48%

25% plus 2% for each percentage point over 35%

48% to 52%

50%

More than 52% to 65%

51% plus 2% for each percentage point over 53%

More than 65% to 100%

100%

* If you have care of a child for 14% to less than 35% of the time, you will not be entitled to receive

Family Tax Benefit, but you may be entitled to receive additional family assistance (Rent Assistance, a

Health Care Card, the lower threshold of the Medicare Safety Net, Remote Area Allowance, Child Care

Subsidy). To be eligible for these benefits you will need to meet the other family assistance requirements

for that benefit. You can claim these benefits by logging into your Centrelink online account through

myGov or complete a

Claim for Parental Leave Pay and Family Tax Benefit (FA100)

form or go online

to make a claim for Child Care Subsidy. For more information, go to

www.

servicesaustralia.gov.au/childcaresubsidy

Continued

Family and

domestic violence

If you are affected by family and domestic violence, there is help available. Call

132 850

Monday to Friday, 8 am to 5 pm local time, and ask to speak to a social worker. Otherwise,

you can contact 1800RESPECT (

1800 737 732

), a 24 hour service. If you are in immediate

danger, call

000

. For more information, go to

www.

servicesaustralia.gov.au/domesticviolence

FA012.2407

3 of 12

It is in your interest to confirm your care arrangements with the other parent, carer or guardian to

avoid any incorrect payments. If you share the care of your children with someone else, they may

be able to claim Family Tax Benefit.

If you have care of a child for more than 65% of the time, you may be entitled to all of the Family

Tax Benefit.

Example 1

Lewis lives with Maria, their mother. Lewis spends every second weekend from Friday night

until Monday morning and 10 weeks of school holidays with Danny, their father.

The number of nights per year that Lewis stays with their mother is 231 and stays with their

father for the remaining 134 nights.

Maria has care of Lewis for 64% of the year (that is, 231 nights divided by 365 nights x 100 = 63.28%,

because Maria’s percentage is over 50% their care is rounded up to 64%). Danny’s care is 36%

(134 nights divided by 365 nights x 100 = 36.71%, because Danny’s percentage is under 50%

their percentage is rounded down to 36%).

Example 2

Michael works night shift and cares for 3 year old child Erin for 6 hours per day Monday to

Thursday and 7 hours on Fridays. The rest of the time, Erin lives with Claire, their mother.

Michael cares for Erin 31 hours each week, or 1612 hours per year. By dividing 1612 hours by

24 hours, we can work out how many ‘days’ Michael cares for Erin – in this case, 67 days.

This is 18% of the year (that is, 67 days divided by 365 days x 100=18%). As this is less than

35%, Michael is not entitled to Family Tax Benefit, while Claire will receive 100%.

What is a care period?

A care period refers to the period that the care arrangements for a child will be in place.

It is used by us to calculate the correct rate of Family Tax Benefit for each child in your care.

A care period:

• begins on the day on which the care of a child starts to be shared between two or more

people, or the day on which the pattern of care changes

• ends when there is a subsequent change in care.

Written Agreements for care arrangements

Where both carers sign the

Details of your child’s care arrangements (FA012)

form and

agree that the care arrangements are ongoing/indefinite, this form can be considered a written

agreement. If this form is considered a written agreement and one carer departs from the care

arrangements without the agreement of the other carer, family assistance and child support may

be assessed based on this original written agreement for an interim period.

Children from a

previous relationship

Situations where you may have a child from a previous relationship include when you are either:

• a single parent

• partnered and your current partner is not the child’s parent

• partnered where you are not the child’s parent, but your partner is.

Your payments will be affected if you do not provide your child support details.

If any dependent child, in your care, is from a previous relationship, you must apply for a child

support assessment within 13 weeks (91 days) of the latest of the following dates:

• the date the child was born

• the date you separated from the child’s other parent

• the date the child came into your care

• the date your percentage of care increased to 35% or above

• such later date that you first became entitled to apply for child support.

FA012.2407

4 of 12

Applying for a child

support assessment

To get more than the base rate of Family Tax Benefit Part A, you are required to apply for child

support from the other parent if you are not currently partnered to that person. The requirement

to apply for child support, also applies to your current partner if they have a child from a previous

relationship in their care.

For more information, go to

www.

servicesaustralia.gov.au/childsupport

Exemptions from

seeking child support

If you are unable to apply for a child support assessment, for any reason such as family domestic

violence or parentage unknown, you should discuss your situation with us. In some cases,

exemptions need to be assessed by a social worker.

If you have not already, you will need to provide your child’s birth certificate. You can call

136 150

Monday to Friday, 8 am and 5 pm local time, to discuss your situation and if required, you will be

referred to a social worker.

Family Relationship

Centres

Family Relationship Advice Line

— provide information, advice and dispute resolution to help

parents/carers focus on the needs of the children and develop workable arrangements for the

children without going to court.

Visit

www.

familyrelationships.gov.au

or call Freecall™

1800 050 321

Providing evidence to

support your claim

Evidence may be required to support your claim. We will need evidence for informal changes

in care.

Evidence of a formal care arrangement may include:

• a Family Law Order

• a Parenting Plan or Order. Parenting plans can be made without the involvement of a third party,

however assistance is available from Family Relationship Centres

• a Custody Order

• a Foster Care placement

• a Court Order for graduated return to care where a child is being integrated back into the family.

Evidence to support an informal care arrangement may include:

• playgroup, day care, kindergarten, preschool or school enrolment listing the emergency

contact or who registered the child

• proof of attendance or membership of organisations or activities indicating your caring

responsibilities

• receipts for expenses incurred while in your care

• proof of travel arrangements such as, airline bookings or passports showing travel dates

• social worker reports

• records from other government departments which may confirm patterns of care

• a diary or calendar to show when you care for the child.

Assistance with child

care fees

If you share the care of a child for at least 14% of the time who is attending approved child care

and you have liability for the fees, you may be eligible for Child Care Subsidy.

In order to receive Child Care Subsidy, each person liable for the fees needs to make a claim.

For more information, go to

www.

servicesaustralia.gov.au/childcaresubsidy

FA012.2407

5 of 12

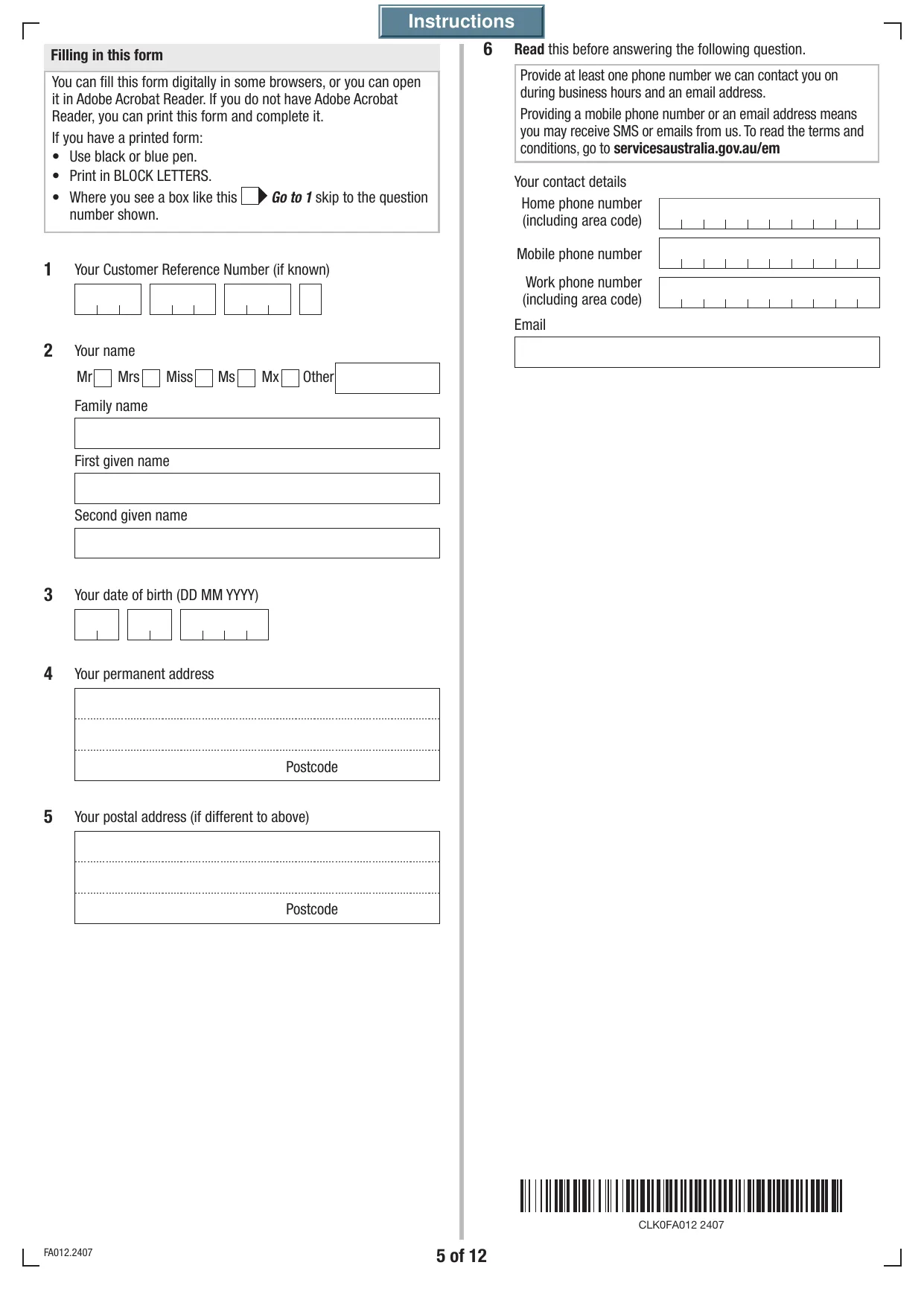

2

Your name

Family name

First given name

Second given name

3

Your date of birth (DD MM YYYY)

Your Customer Reference Number (if known)

1

4

Your permanent address

Postcode

5

Your postal address (if different to above)

Postcode

6

Read

this before answering the following question.

Provide at least one phone number we can contact you on

during business hours and an email address.

Providing a mobile phone number or an email address means

you may receive SMS or emails from us. To read the terms and

conditions, go to

www.

servicesaustralia.gov.au/em

Your contact details

Home phone number

(including area code)

Mobile phone number

Work phone number

(including area code)

You can fill this form digitally in some browsers, or you can open

it in Adobe Acrobat Reader. If you do not have Adobe Acrobat

Reader, you can print this form and complete it.

If you have a printed form:

• Use black or blue pen.

• Print in BLOCK LETTERS.

• Where you see a box like this

Go to 1

skip to the question

number shown.

Filling in this form

Other

Mr

Mrs

Ms

Mx

Miss

CLK0FA012 2407

Instructions

FA012.2407

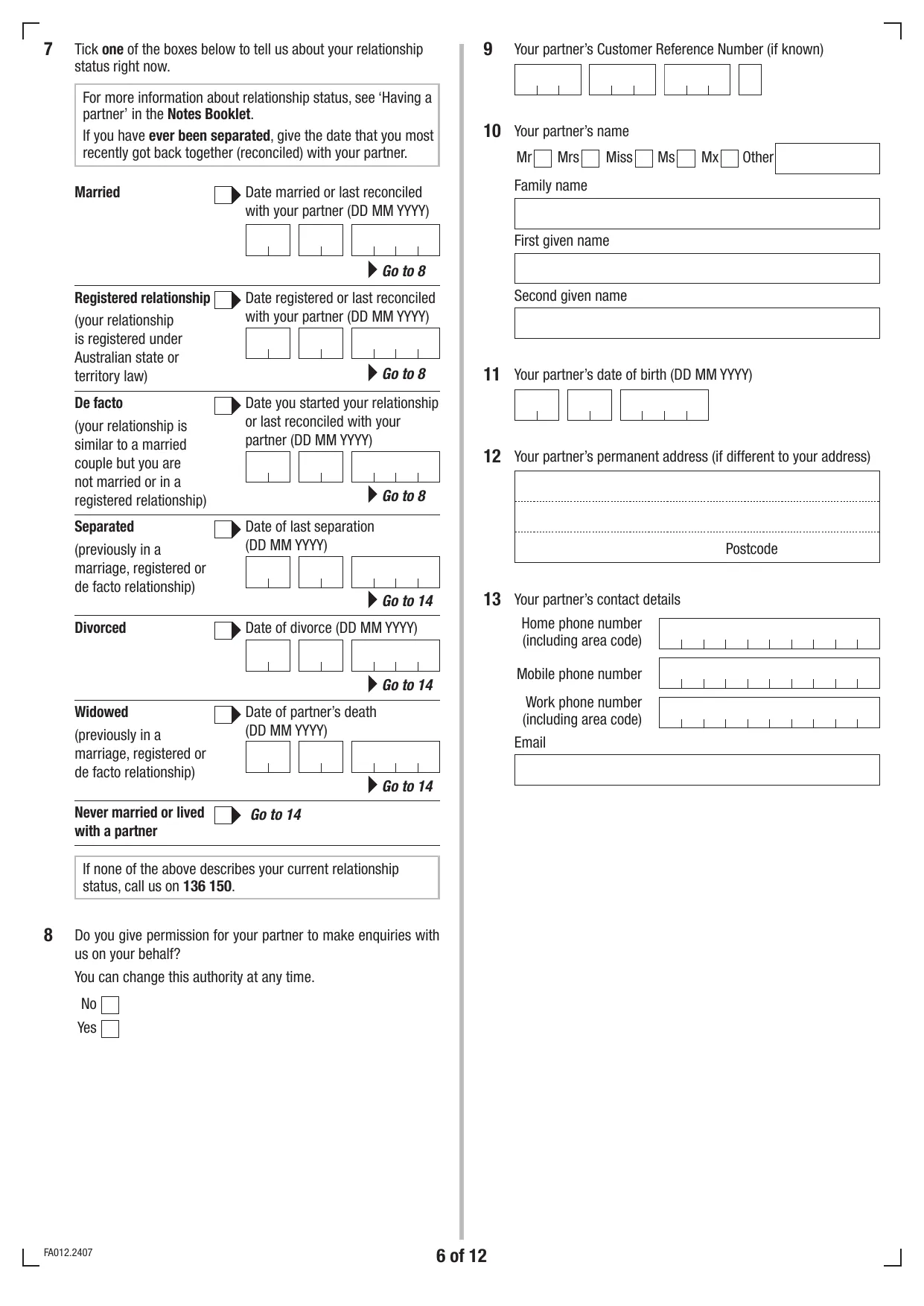

6 of 12

10

Your partner’s name

Family name

First given name

Second given name

11

Your partner’s date of birth (DD MM YYYY)

12

Your partner’s permanent address (if different to your address)

Postcode

13

Your partner’s contact details

7

8

For more information about relationship status, see ‘Having a

partner’ in the

Notes Booklet

.

If you have

ever been separated

, give the date that you most

recently got back together (reconciled) with your partner.

If none of the above describes your current relationship

status, call us on

136 150

.

Do you give permission for your partner to make enquiries with

us on your behalf?

You can change this authority at any time.

No

Yes

Tick

one

of the boxes below to tell us about your relationship

status right now.

Your partner’s Customer Reference Number (if known)

9

Married

Date married or last reconciled

with your partner (DD MM YYYY)

Go to 8

Registered relationship

(your relationship

is registered under

Australian state or

territory law)

Date registered or last reconciled

with your partner (DD MM YYYY)

Go to 8

De facto

(your relationship is

similar to a married

couple but you are

not married or in a

registered relationship)

Date you started your relationship

or last reconciled with your

partner (DD MM YYYY)

Go to 8

Separated

(previously in a

marriage, registered or

de facto relationship)

Date of last separation

(DD MM YYYY)

Go to 14

Divorced

Date of divorce (DD MM YYYY)

Go to 14

Widowed

(previously in a

marriage, registered or

de facto relationship)

Date of partner’s death

(DD MM YYYY)

Go to 14

Never married or lived

with a partner

Go to 14

Home phone number

(including area code)

Mobile phone number

Work phone number

(including area code)

Other

Mr

Mrs

Ms

Mx

Miss

FA012.2407

Child 1

7 of 12

14

Give details of the dependent child(ren) in your care who spend time with someone other than your current partner.

On this form we have allowed space for two dependent children. If you share the care of more than 2 dependent children, or if any

of your dependent children spend time with more than one other parent, carer or guardian, copy and provide pages 7 and 8 for

each additional child before completing the details for child 1 and 2.

15

Child’s family name

Child’s given name(s)

16

Child’s date of birth (DD MM YYYY)

17

Your

relationship to this child

The term ‘parent’ refers to a natural, adoptive or relationship

parent (a person who is legally responsible for a child

born through an artificial conception procedure or where a

surrogacy court order is in place).

Parent

Adoptive parent

Grandparent

Step-parent

Foster carer

Other

Give details below

18

Your partner’s

(if you have one) relationship to this child

Parent

Adoptive parent

Grandparent

Step-parent

Foster carer

Other

Give details below

19

Are you (and/or your partner) currently receiving fortnightly

payments, including receiving a zero rate of Family Tax

Benefit or receiving Child Care Subsidy for this child?

No

Go to next question

Go to 21

Yes

20

Do you want to test your eligibility for Family Tax Benefit or

Child Care Subsidy for this child?

No

Yes

Go to next question

Continue to complete and return this form.

If you are

not

currently receiving Family Tax

Benefit or Child Care Subsidy for any child(ren),

and wish to make a claim for this child, log into

your Centrelink online account through myGov,

then select

Make a Claim

.

Go to next question

21

Read

this before answering the following questions.

Date the current care arrangement started

Date these arrangements are expected to end or change

(if applicable)

For shared care purposes, your percentage of

care will be assessed over a 12 month period

from the date the care commenced. This is

called a care period and the percentage will be

maintained for subsequent years unless you

advise us of a change.

For information about care periods, see ‘What is

a care period?’ on page 3.

You will need to contact us to update your care

arrangements when these arrangements end or change.

If you agree the care arrangements are indefinite/ongoing

and this form is signed by both carers, this form may be

considered a written agreement.

For more information about care arrangements, see

‘Written Agreements for care arrangements’ on page 3.

No

Go to next question

Yes

22

Your care arrangement

Are your care arrangements indefinite/ongoing?

23

Do you have a parenting plan, court order or written

agreement that shows where this child stays?

No

Go to 25

Yes

Provide a copy of the parenting plan, court

order or written agreement.

(DD MM YYYY)

(DD MM YYYY)

FA012.2407

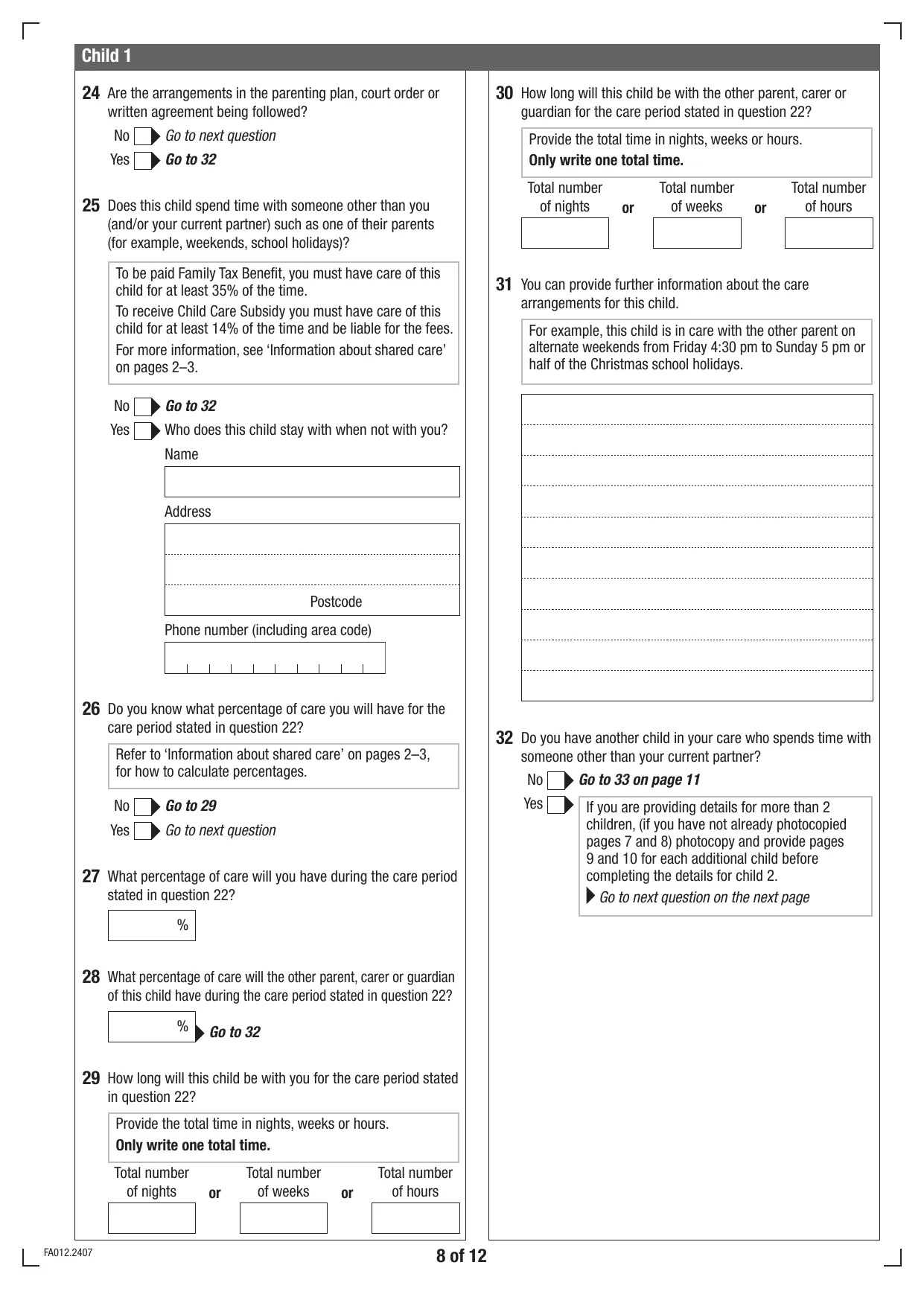

8 of 12

Child 1

25

Does this child spend time with someone other than you

(and/or your current partner) such as one of their parents

(for example, weekends, school holidays)?

To be paid Family Tax Benefit, you must have care of this

child for at least 35% of the time.

To receive Child Care Subsidy you must have care of this

child for at least 14% of the time and be liable for the fees.

For more information, see ‘Information about shared care’

on pages 2–3.

No

Go to 32

Who does this child stay with when not with you?

Yes

Name

Postcode

Address

Phone number (including area code)

26

Do you know what percentage of care you will have for the

care period stated in question 22?

Refer to ‘Information about shared care’ on pages 2–3,

for how to calculate percentages.

No

Go to 29

Go to next question

Yes

What percentage of care will you have during the care period

stated in question 22?

27

%

How long will this child be with the other parent, carer or

guardian for the care period stated in question 22?

30

Provide the total time in nights, weeks or hours.

Only write one total time.

Total number

of nights

Total number

of weeks

Total number

of hours

or

or

You can provide further information about the care

arrangements for this child.

31

For example, this child is in care with the other parent on

alternate weekends from Friday 4:30 pm to Sunday 5 pm

or

half of the Christmas school holidays.

Do you have another child in your care who spends time with

someone other than your current partner?

32

No

Yes

Go to 33 on page 11

If you are providing details for more than 2

children, (if you have not already photocopied

pages 7 and 8) photocopy and provide pages

9 and 10 for each additional child before

completing the details for child 2.

Go to next question on the next page

What percentage of care will the other parent, carer or guardian

of this child have during the care period stated in question 22?

28

%

Go to 32

How long will this child be with you for the care period stated

in question 22?

29

Provide the total time in nights, weeks or hours.

Only write one total time.

Total number

of nights

Total number

of weeks

Total number

of hours

or

or

24

Are the arrangements in the parenting plan, court order or

written agreement being followed?

No

Go to next question

Go to 32

Yes

FA012.2407

9 of 12

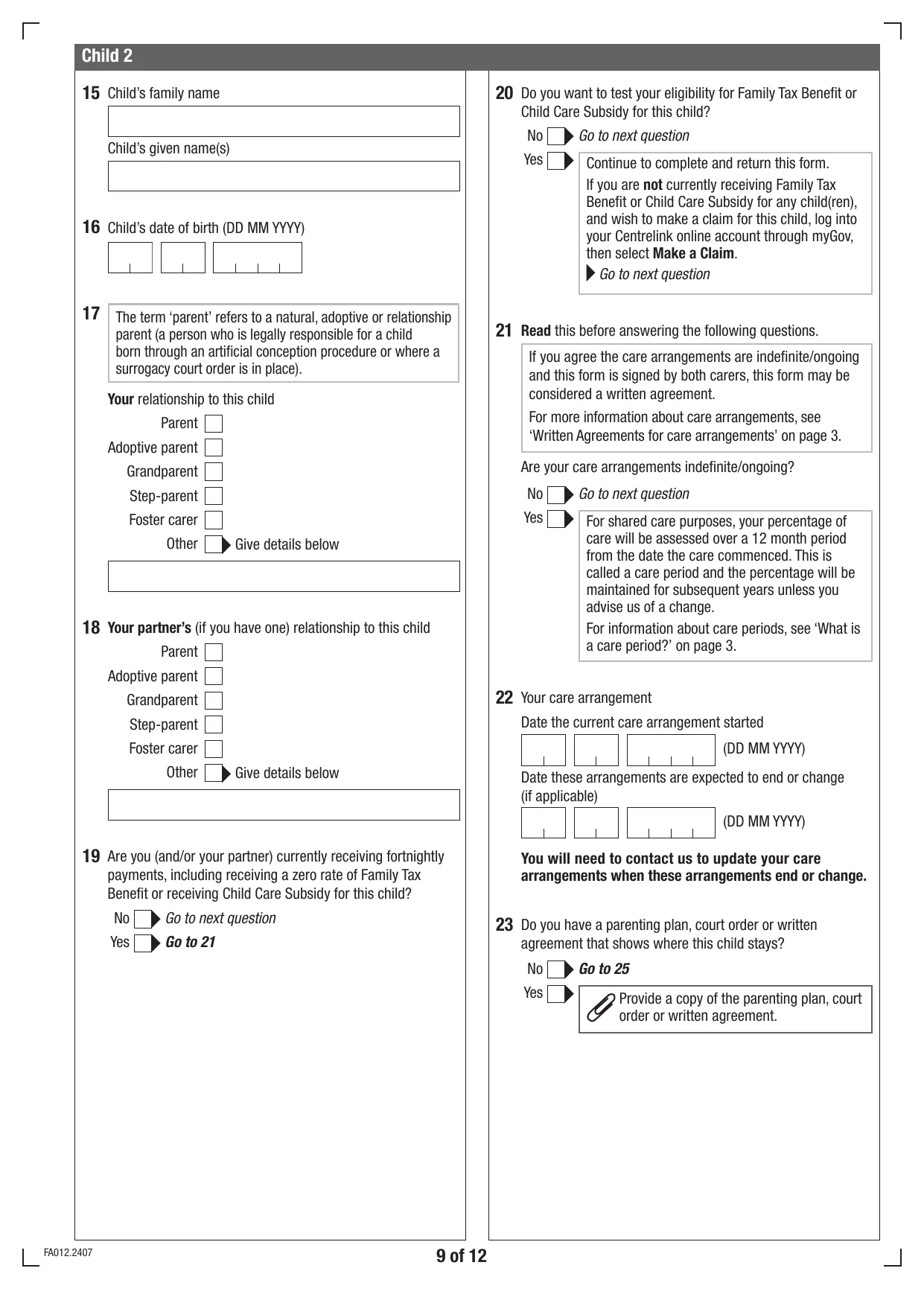

Child 2

15

Child’s family name

Child’s given name(s)

16

Child’s date of birth (DD MM YYYY)

17

Your

relationship to this child

The term ‘parent’ refers to a natural, adoptive or relationship

parent (a person who is legally responsible for a child

born through an artificial conception procedure or where a

surrogacy court order is in place).

Parent

Adoptive parent

Grandparent

Step-parent

Foster carer

Other

Give details below

18

Your partner’s

(if you have one) relationship to this child

Parent

Adoptive parent

Grandparent

Step-parent

Foster carer

Other

Give details below

19

Are you (and/or your partner) currently receiving fortnightly

payments, including receiving a zero rate of Family Tax

Benefit or receiving Child Care Subsidy for this child?

No

Go to next question

Go to 21

Yes

20

Do you want to test your eligibility for Family Tax Benefit or

Child Care Subsidy for this child?

No

Yes

Go to next question

Continue to complete and return this form.

If you are

not

currently receiving Family Tax

Benefit or Child Care Subsidy for any child(ren),

and wish to make a claim for this child, log into

your Centrelink online account through myGov,

then select

Make a Claim

.

Go to next question

23

Do you have a parenting plan, court order or written

agreement that shows where this child stays?

No

Go to 25

Yes

Provide a copy of the parenting plan, court

order or written agreement.

21

Read

this before answering the following questions.

Date the current care arrangement started

Date these arrangements are expected to end or change

(if applicable)

For shared care purposes, your percentage of

care will be assessed over a 12 month period

from the date the care commenced. This is

called a care period and the percentage will be

maintained for subsequent years unless you

advise us of a change.

For information about care periods, see ‘What is

a care period?’ on page 3.

You will need to contact us to update your care

arrangements when these arrangements end or change.

If you agree the care arrangements are indefinite/ongoing

and this form is signed by both carers, this form may be

considered a written agreement.

For more information about care arrangements, see

‘Written Agreements for care arrangements’ on page 3.

No

Go to next question

Yes

22

Your care arrangement

Are your care arrangements indefinite/ongoing?

(DD MM YYYY)

(DD MM YYYY)

FA012.2407

10 of 12

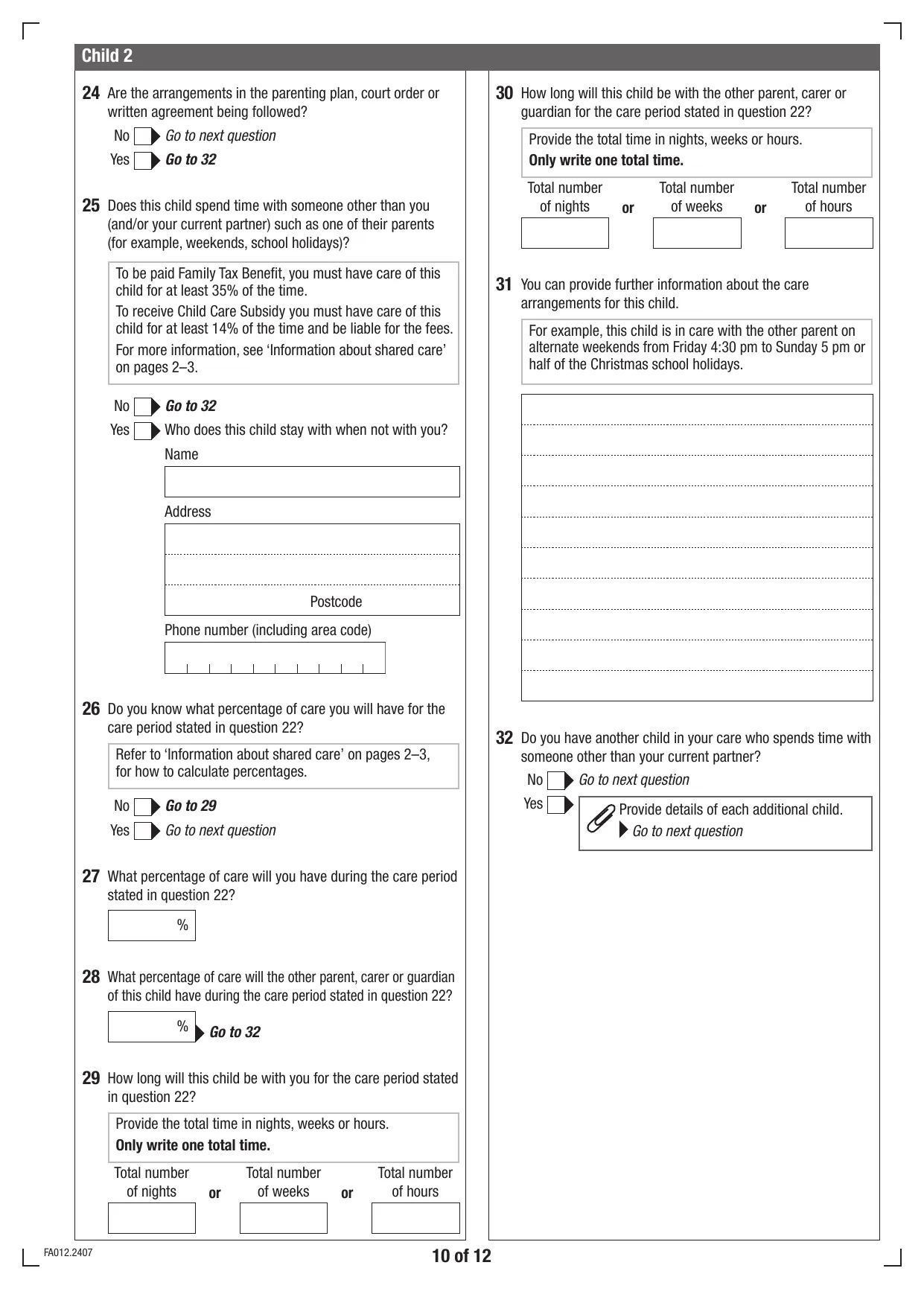

Child 2

25

Does this child spend time with someone other than you

(and/or your current partner) such as one of their parents

(for example, weekends, school holidays)?

To be paid Family Tax Benefit, you must have care of this

child for at least 35% of the time.

To receive Child Care Subsidy you must have care of this

child for at least 14% of the time and be liable for the fees.

For more information, see ‘Information about shared care’

on pages 2–3.

No

Go to 32

Who does this child stay with when not with you?

Yes

Name

Postcode

Address

Phone number (including area code)

26

Do you know what percentage of care you will have for the

care period stated in question 22?

Refer to ‘Information about shared care’ on pages 2–3,

for how to calculate percentages.

No

Go to 29

Go to next question

Yes

What percentage of care will you have during the care period

stated in question 22?

27

%

What percentage of care will the other parent, carer or guardian

of this child have during the care period stated in question 22?

28

%

Go to 32

How long will this child be with you for the care period stated

in question 22?

29

Provide the total time in nights, weeks or hours.

Only write one total time.

Total number

of nights

Total number

of weeks

Total number

of hours

or

or

How long will this child be with the other parent, carer or

guardian for the care period stated in question 22?

30

Provide the total time in nights, weeks or hours.

Only write one total time.

Total number

of nights

Total number

of weeks

Total number

of hours

or

or

You can provide further information about the care

arrangements for this child.

31

For example, this child is in care with the other parent on

alternate weekends from Friday 4:30 pm to Sunday 5 pm

or

half of the Christmas school holidays.

Do you have another child in your care who spends time with

someone other than your current partner?

32

No

Yes

Go to next question

Provide details of each additional child.

Go to next question

24

Are the arrangements in the parenting plan, court order or

written agreement being followed?

No

Go to next question

Go to 32

Yes

FA012.2407

11 of 12

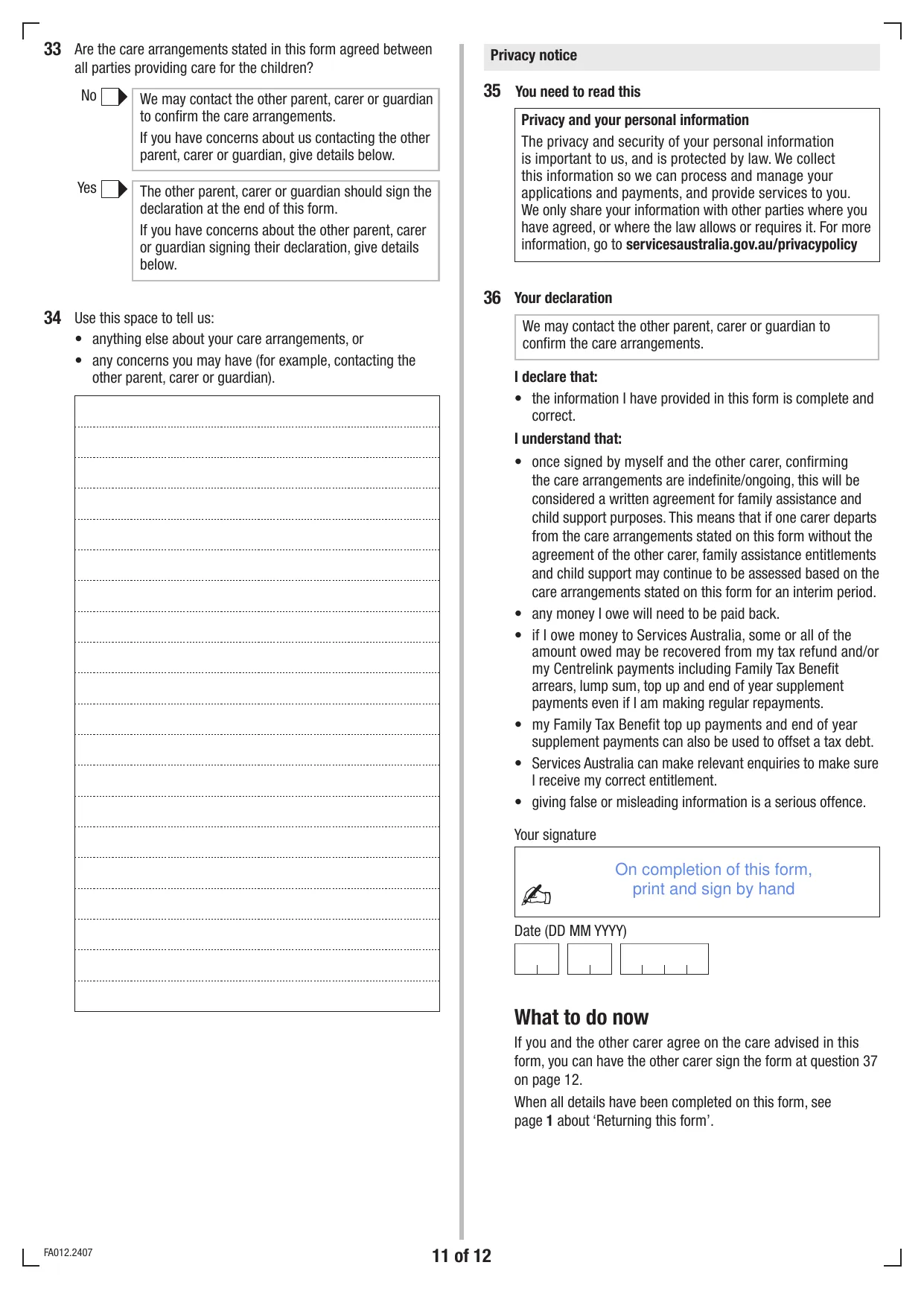

33

Are the care arrangements stated in this form agreed between

all parties providing care for the children?

No

Yes

We may contact the other parent, carer or guardian

to confirm the care arrangements.

If you have concerns about us contacting the other

parent, carer or guardian, give details below.

The other parent, carer or guardian should sign the

declaration at the end of this form.

If you have concerns about the other parent, carer

or guardian signing their declaration, give details

below.

34

Use this space to tell us:

• anything else about your care arrangements, or

• any concerns you may have (for example, contacting the

other parent, carer or guardian).

35

You need to read this

Privacy notice

Privacy and your personal information

The privacy and security of your personal information

is important to us, and is protected by law. We collect

this information so we can process and manage your

applications and payments, and provide services to you.

We only share your information with other parties where you

have agreed, or where the law allows or requires it. For more

information, go to

www.

servicesaustralia.gov.au/privacypolicy

36

Your declaration

We may contact the other parent, carer or guardian to

confirm the care arrangements.

I declare that:

• the information I have provided in this form is complete and

correct.

I understand that:

• once signed by myself and the other carer, confirming

the care arrangements are indefinite/ongoing, this will be

considered a written agreement for family assistance and

child support purposes. This means that if one carer departs

from the care arrangements stated on this form without the

agreement of the other carer, family assistance entitlements

and child support may continue to be assessed based on the

care arrangements stated on this form for an interim period.

• any money I owe will need to be paid back.

• if I owe money to Services Australia, some or all of the

amount owed may be recovered from my tax refund and/or

my Centrelink payments including Family Tax Benefit

arrears, lump sum, top up and end of year supplement

payments even if I am making regular repayments.

• my Family Tax Benefit top up payments and end of year

supplement payments can also be used to offset a tax debt.

• Services Australia can make relevant enquiries to make sure

I receive my correct entitlement.

• giving false or misleading information is a serious offence.

Your signature

Date (DD MM YYYY)

What to do now

If you and the other carer agree on the care advised in this

form, you can have the other carer sign the form at question 37

on page 12.

When all details have been completed on this form, see

page

1

about ‘Returning this form’.

On completion of this form,

print and sign by hand

FA012.2407

12 of 12

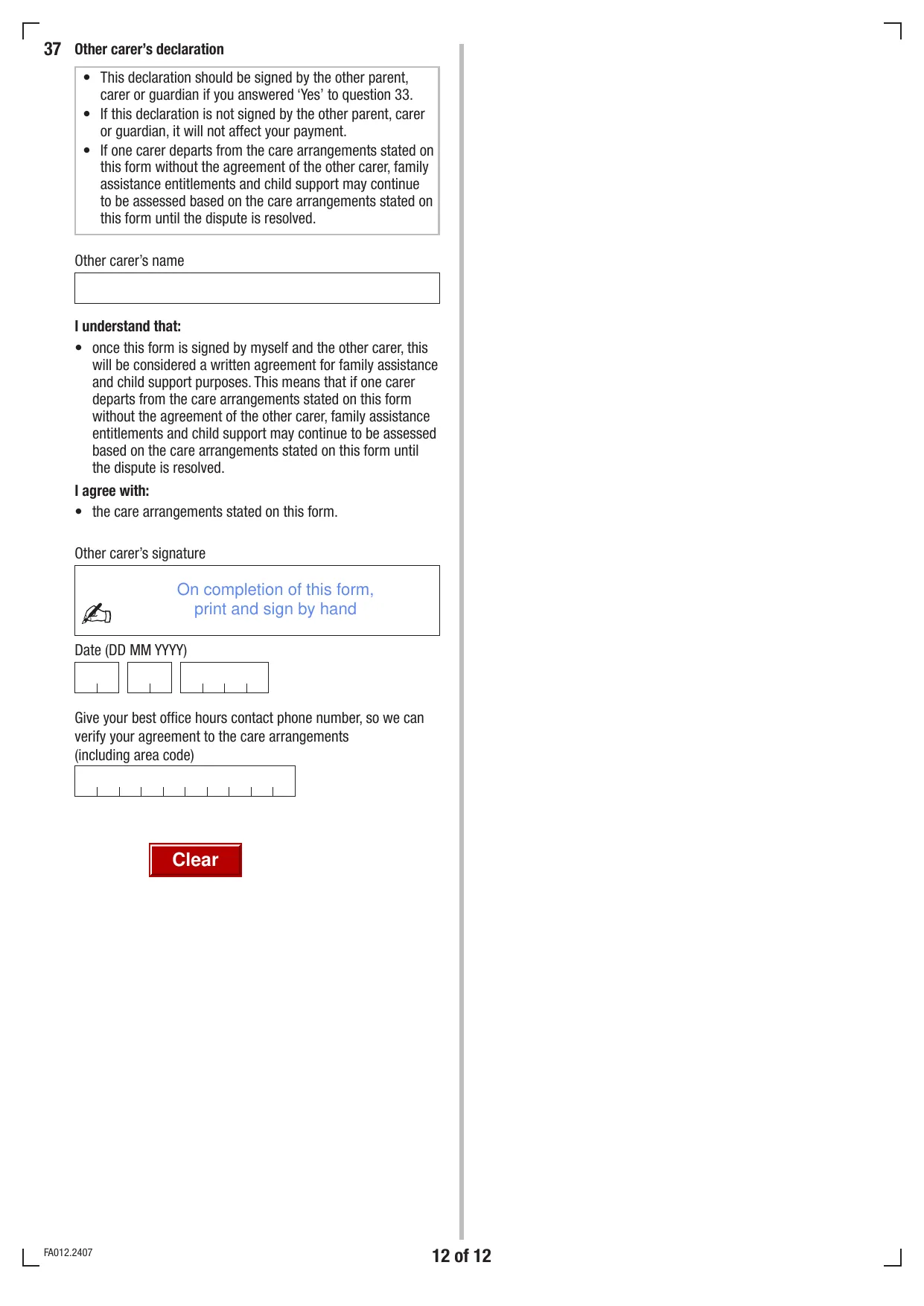

37

Other carer’s declaration

• This declaration should be signed by the other parent,

carer or guardian if you answered ‘Yes’ to question 33.

• If this declaration is not signed by the other parent, carer

or guardian, it will not affect your payment.

• If one carer departs from the care arrangements stated on

this form without the agreement of the other carer, family

assistance entitlements and child support may continue

to be assessed based on the care arrangements stated on

this form until the dispute is resolved.

Other carer’s name

I understand that:

• once this form is signed by myself and the other carer, this

will be considered a written agreement for family assistance

and child support purposes. This means that if one carer

departs from the care arrangements stated on this form

without the agreement of the other carer, family assistance

entitlements and child support may continue to be assessed

based on the care arrangements stated on this form until

the dispute is resolved.

I agree with

:

• the care arrangements stated on this form.

Other carer’s signature

Give your best office hours contact phone number, so we can

verify your agreement to the care arrangements

(including area code)

Date (DD MM YYYY)

On completion of this form,

print and sign by hand

Clear